Useful Tips Concerning Residence Mortgages That Straightforward To Follow

Created by-Jimenez SkouFinding the right home can be very stressful, but even more so when it involved trying to get approved for a mortgage. If you are in search of a home mortgage but not up to date on what is needed to satisfy the requirements, then you will need to get educated. Read on for great home mortgage tips that anyone can use.

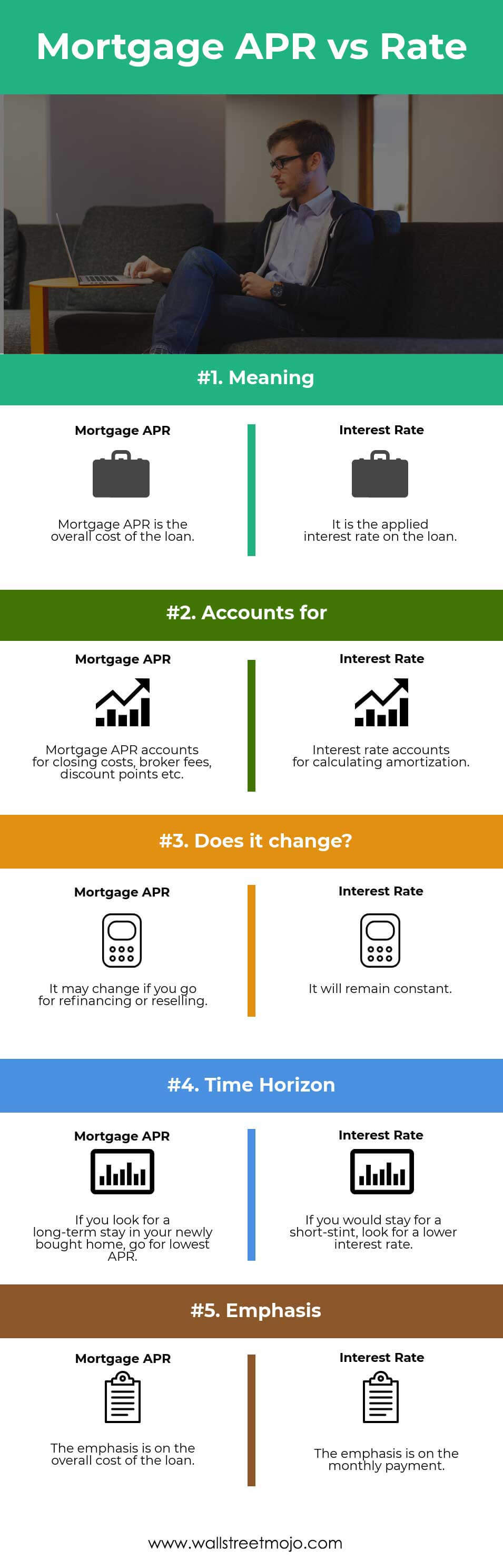

Remember that the interest rate isn't the most important part of a mortgage. You also have to think about closing costs, points and other incidentals. There are different kinds of loan as well. That is why you have to find out as much as you can about what you're eligible for.

Before applying for a mortgage loan, check your credit score and credit history. Any lender you visit will do this, and by checking on your credit before applying you can see the same information they will see. You can then take the time to clean up any credit problems that might keep you from getting a loan.

If you are considering quitting your job or accepting employment with a different company, delay the change until after the mortgage process has closed. Your mortgage loan has been approved based on the information originally submitted in your application. Any alteration can force a delay in closing or may even force your lender to overturn the decision to approve your loan.

If your house is worth less than what you owe and you've been unsuccessful in refinancing it, try again. HARP is allowing homeowners to refinance regardless of how bad their situation currently is. Consider having a conversation with your mortgage lender to see if you qualify. If your lender is still not willing to work with you, find another one who will.

Your application can be rejected because of any new changes to your finances. Make sure you have stable employment before applying for a mortgage. Don't change jobs during the mortgage process either, or your lender may decide you are no longer a good risk.

Pay off your mortgage sooner by scheduling bi-weekly payments instead of monthly payments. You will end up making several extra payments per year and decrease the amount you pay in interest over the life of the loan. This bi-weekly payment can be automatically deducted from your bank account to make it easy and convenient.

Check with your local Better Business Bureau before giving personal information to any lender. Unfortunately, there are predatory lenders out there that are only out to steal your identity. By checking with your BBB, you can ensure that you are only giving your information to a legitimate home mortgage lender.

Hire an attorney to help you understand your mortgage terms. Even those with degrees in accounting can find it difficult to fully understand the terms of a mortgage loan, and just trusting someone's word on what everything means can cause you problems down the line. Get an attorney to look it over and make everything clear.

Choose your mortgage lender many months in advance to your actual home buy. Buying a home is a stressful thing. There are a lot of moving pieces. If you already know who your mortgage lender will be, that's one less thing to worry about once you've found the home of your dreams.

If your mortgage is a 30 year one, think about making extra payments to help speed up the pay off process. The additional amount you pay can help pay down the principle. Making an extra payment often gets your mortgage paid off faster and saves you money on interest.

Pay off look at more info by scheduling bi-weekly payments instead of monthly payments. You will end up making several extra payments per year and decrease the amount you pay in interest over the life of the loan. This bi-weekly payment can be automatically deducted from your bank account to make it easy and convenient.

Before applying for a home mortgage, get your debts in order. Consolidate small debts with high interest rates and put a solid effort into paying them off. Do not take on new debt while you are preparing to apply for a home mortgage. The cleaner your debt record when you apply for a home mortgage, the better your chances of getting approval for a good loan at a good rate.

Do not even consider getting a home mortgage that is only paying the interest. This is the worst possible investment that you can make. The problem is that you are not getting any closer to actually owning your home. Instead, purchase a home that you can afford to pay principle on so that you are truly making a good investment.

There are many programs online that offer mortgage financing. You no longer have to go to a physical location to get a loan. A lot of reputable lenders have begun to offer mortgage services online, exclusively. This allows them to offer lower rates and faster approval times.

You may want to consider refinancing your home mortgage. Interest rates have gone down a great deal in recent years, and due to this you could pay thousands less over the term of your loan if you refinance now. This is something that you must consider if you are pay just a fraction of a percent more than what you could pay now.

Do not even bother with looking at houses before you have applied for a home mortgage. When you have pre-approval, you know how much money you have to work with. Additionally, pre- find out here now means you do not have to rush. You can take your time looking at homes knowing that you have money in your pocket.

If you come into some money for any reason, do not go on a spending spree. The best investment you can make is in your home. Use unexpected cash to pay down your mortgage quicker. This means you have to pay less interest. It also lets you become the true homeowner sooner.

Though you may feel a little overwhelmed with financing your home mortgage, you can use the tips you got here to boost your confidence. Most of the stress of home buying is from not fully understanding the process. If you keep the information you got here in mind, you are already ahead of the game.